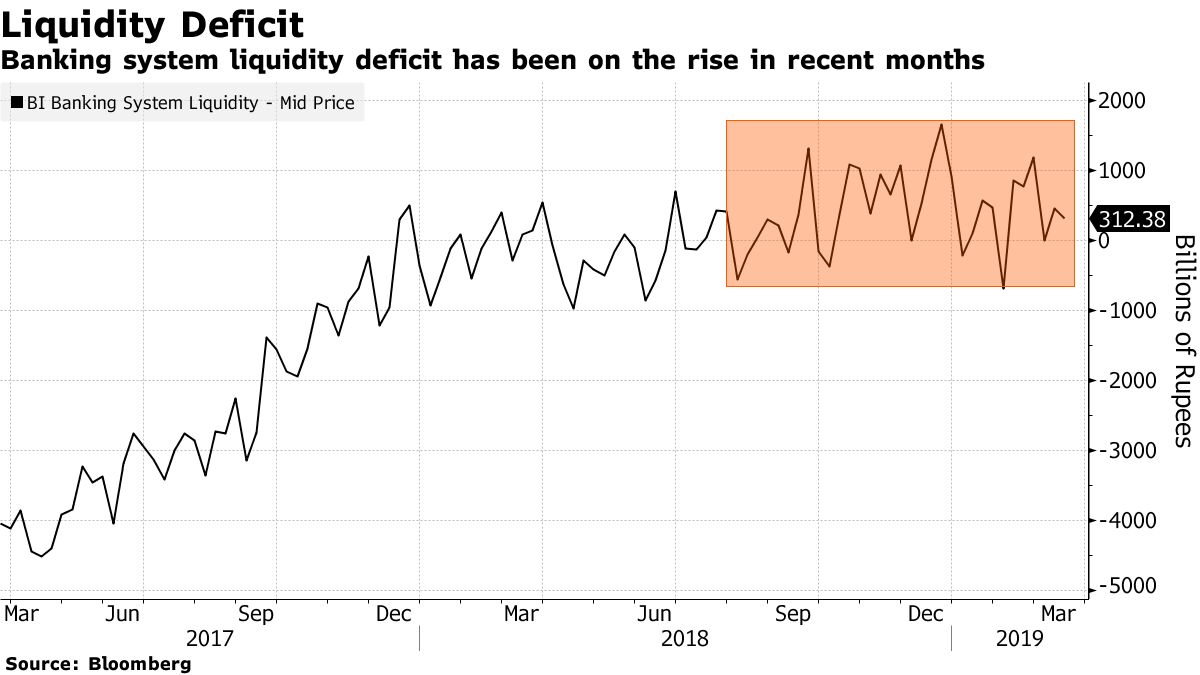

The ripple effects of the Reserve Bank of India’s unusual move to use foreign-exchange swaps to ease a liquidity deficit at banks ahead of national elections were felt across local currency, stocks and bond markets on Thursday.

Sovereign bonds fell as traders speculated that the measure would reduce the need for the central bank to buy debt via open-market operations, removing a key support for the market. The rupee weakened as some analysts saw the decision as a signal that the RBI isn’t comfortable with the currency’s recent gains, while some financial stocks cheered the planned liquidity infusion.

The RBI will hold a $5 billion foreign-exchange swap auction for a three-year tenor on March 26, it said late Wednesday. The plan comes as India is estimated to spend an unprecedented 500 billion rupees ($7.2 billion) to conduct a six-week-long vote starting next month. That, along with a seasonal shortage before the fiscal year-end, is putting a strain on banking liquidity.

Below is the impact the RBI’s move has had on different asset classes, with comments from market watchers. For more details on the swap plan itself, click here.

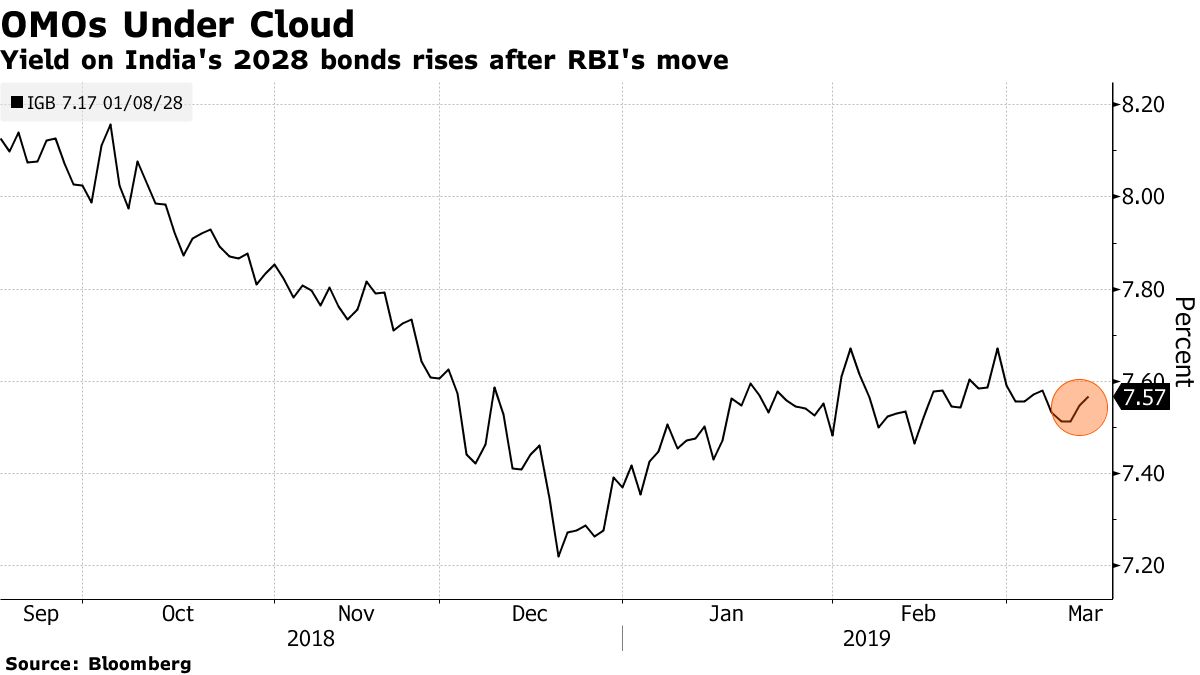

Bonds

The yield on India’s most-traded 2028 sovereign debt rose two basis points to 7.56 percent.

If the FX swap “becomes a regular tool, it reduces the need of OMO buybacks,” said Vivek Rajpal, a rates strategist at Nomura Holdings Inc. in Singapore. The RBI is forecast to have spent a record 3 trillion rupees on OMO purchases in the year ending March, acting as a key support for the market.

That said, the injection of liquidity via the swap auction should support shorter-term bonds, according to some analysts, as investors will be wary of the longer end due to the government’s heavy borrowing from April to plug its budget gap.

Rupee

The rupee was down 0.1 percent against the dollar on Thursday, halting a three-day gain. Even so, it remains Asia’s top performer over the past month as foreign inflows into equities and bonds have surged, and the nation’s military tension with Pakistan has eased. Stocks have attracted $4.1 billion so far this year.

“The move prima facie looks to be rupee negative, amid higher rupee-liquidity creation,” said Madhavi Arora, an economist at Edelweiss Securities Ltd. “However, if the dollars come via the offshore foreign banks’ route, this particular move per se would be rupee agnostic.”

The RBI had used foreign-exchange swaps in 2013 to stem the losses suffered by the rupee amid an emerging-market rout, asking banks to bring in dollar inflows from non-resident Indians.

“The RBI is telegraphing to the market that it is not comfortable with the current rupee strength,” besides augmenting money supply to manage the fiscal year-end liquidity needs, said Anindya Banerjee, a currency analyst at Kotak Securities Ltd. in Mumbai.

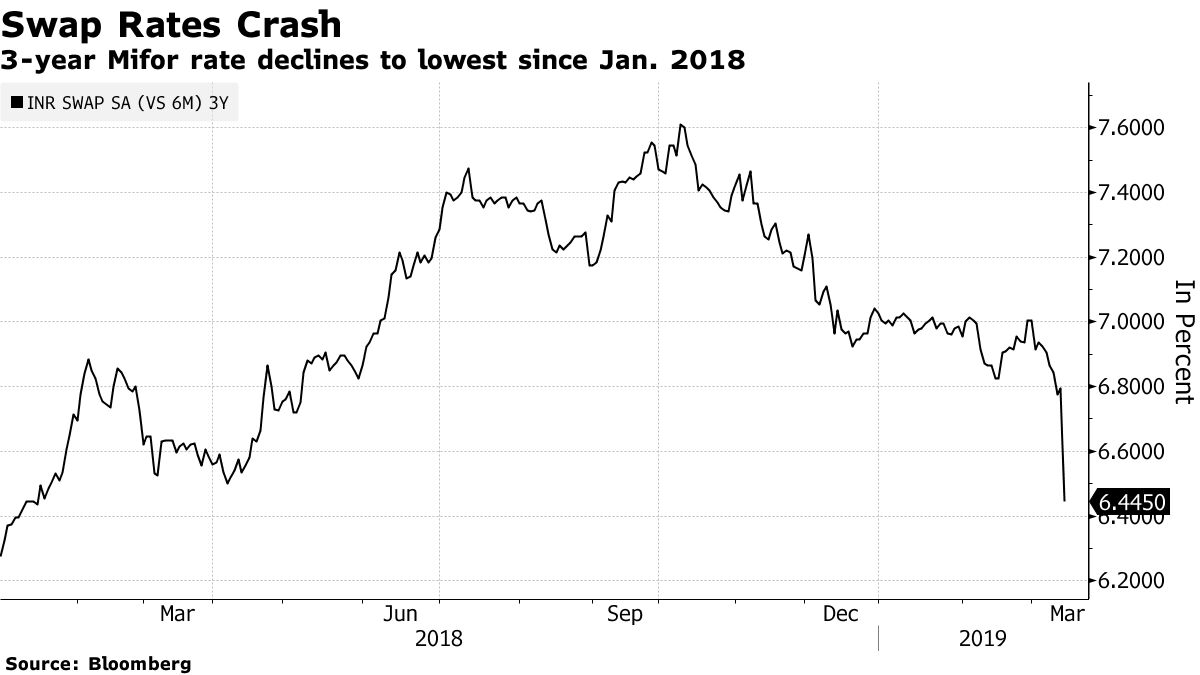

Forward Premia, MIFOR

While the rupee in the spot market showed a muted reaction, one-year dollar/rupee forward premia slipped 28 basis points to 3.60 percent. Some analysts said that the impact of the RBI move on spot will depend on how the banks source dollars to offer to the RBI at the auction.

The lower premiums will reduce hedging costs for foreign investors at a time when the central bank has opened a special route for overseas investment in debt.

Finance Stocks

Some banking stocks rose along with shares of non-banking financial companies in response to the planned fund infusion.

“It addresses the liquidity tightness in the financial system and will help revive credit, said Prakash Pandey, head of research at Delhi-based Fairwealth Securities Ltd.

Dewan Housing Finance Corp. rose as much as 6.9 percent and was the top performer on S&P BSE Finance Index earlier in the day. JM Financial Ltd. climbed as much as 5.8 percent, while Indiabulls Housing Finance Ltd. advanced as much as 3.7 percent.

Credit

The move is also likely to boost overseas interest in Indian corporate bonds by lowering hedging costs.

“A lower hedge cost should incrementally incentivize offshore flow into Indian ‘carry’ assets, chiefly corporate bonds,” said Suyash Choudhary, head of fixed income at IDFC Asset Management Ltd.

This move further enhances the appeal of two-five year AAA corporate bonds on the margin, said Choudhary.

** This article was originally posted on Bloomberg by Kartik Goyal and Subhadip Sircar

Smart swap

** This article was originally posted on BusinessLine